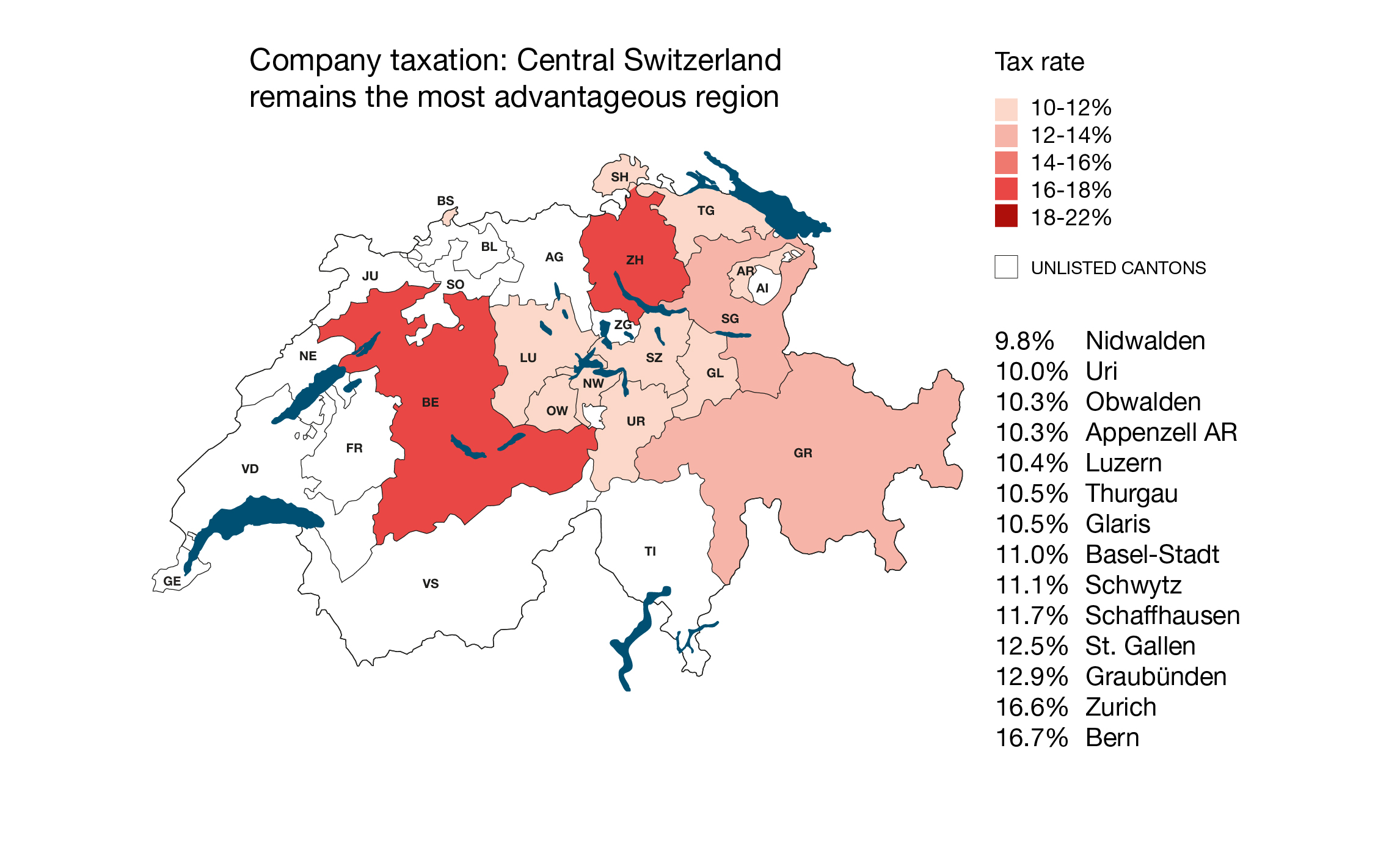

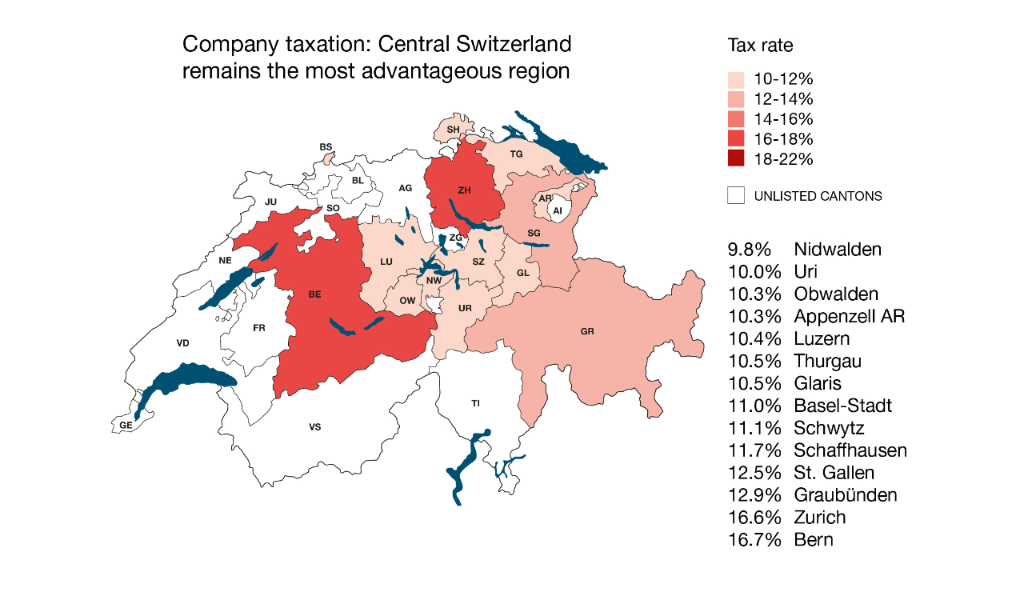

The taxation of companies depends very much on the canton and the municipalities where they are located. The charge may vary from single to double.

Tax competition between the cantons is creating a very large disparity in the taxation of companies, with a difference that may go from single to double. The rate does not only change depending on the canton, but also depending on the municipality.

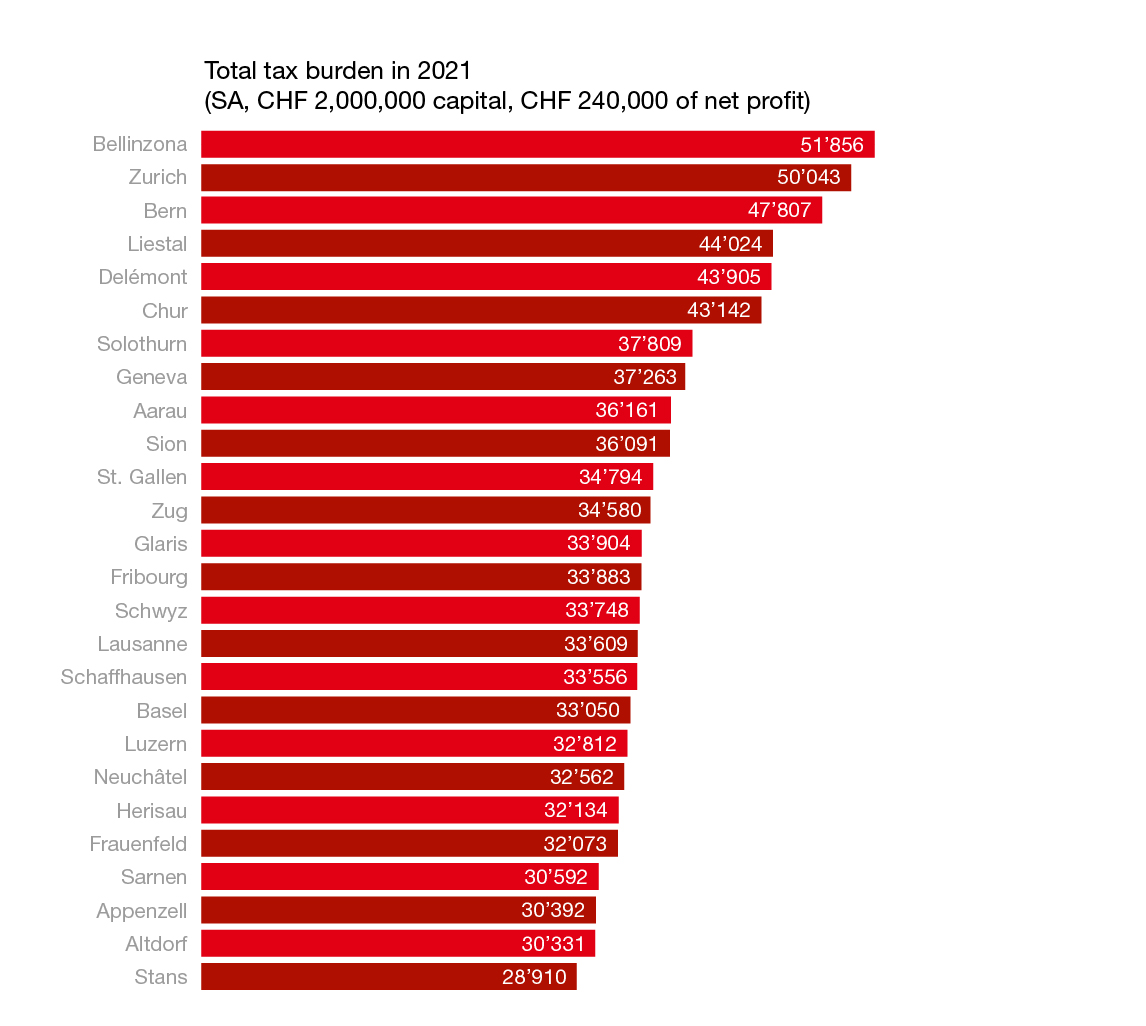

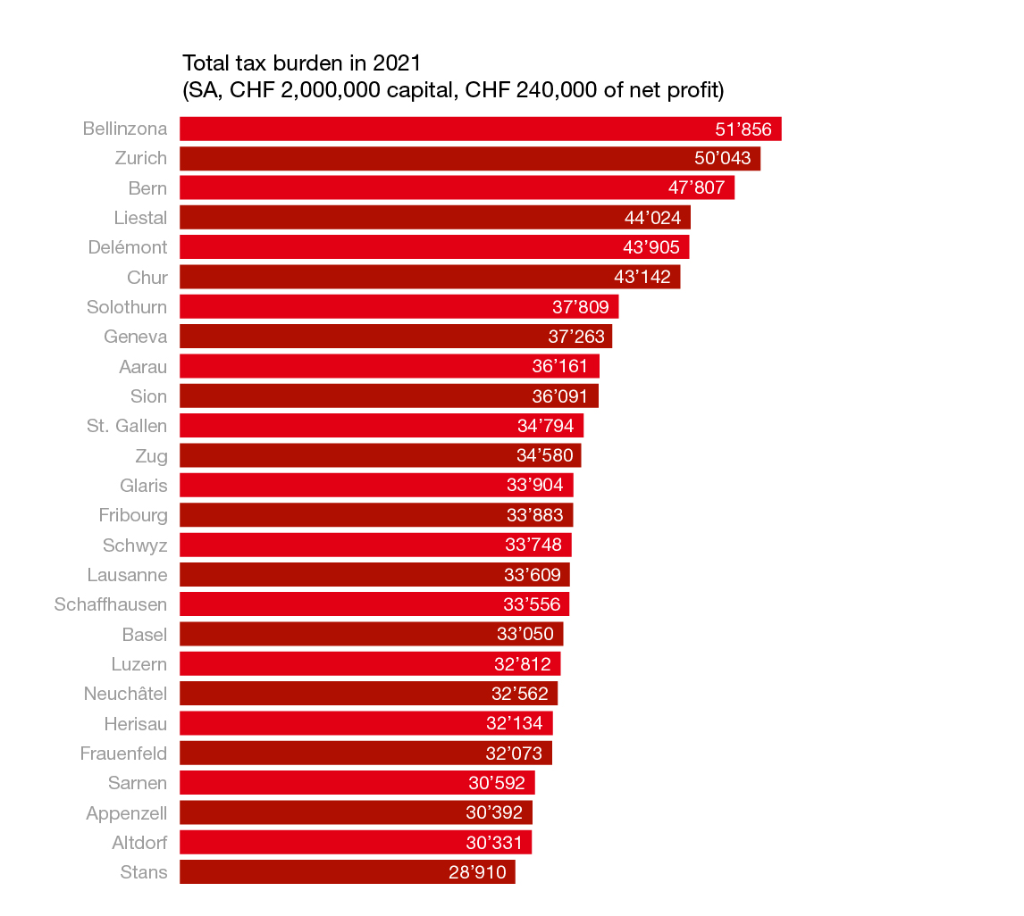

A corporation with a share capital of CHF 2 million which makes a net profit of CHF 240,000 in 2021 pays a total of CHF 51,856 in taxes in Bellinzona compared to CHF 28,910 in Stans (Nidwalden).