Figures on SMEs: Sources of funds

Swiss SMEs are financed essentially with equity. But bank credit is very rarely denied.

About 37% of SMEs are now fully self-financed, compared to 62% in 2016, according to a representative survey of 2,712 Swiss small and medium-sized enterprises conducted by the State Secretariat for Economic Affairs (SECO). This development is explained by the impact of the coronavirus pandemic on the Swiss economy. Loans from family, friends, or shareholders as well as leasing have become increasingly important compared to the previous survey.

However, bank financing remains the most important form of financing for SMEs. The total volume of corporate loans granted by banks in Switzerland increased by 28% from CHF 325 billion in 2015 to CHF 416 billion in June 2021. Of the total volume, around 87% was for SMEs with less than 250 employees. Of the bank financing requests, only 3% were rejected.

There are other ways to raise funds. Approximately forty Swiss SMEs have, for example, issued stocks or bonds on the Bern Stock Exchange, which targets the market of small and medium-sized enterprises specifically, unlike the Zurich stock exchange. As for start-ups, a large number of them use venture capital investors.

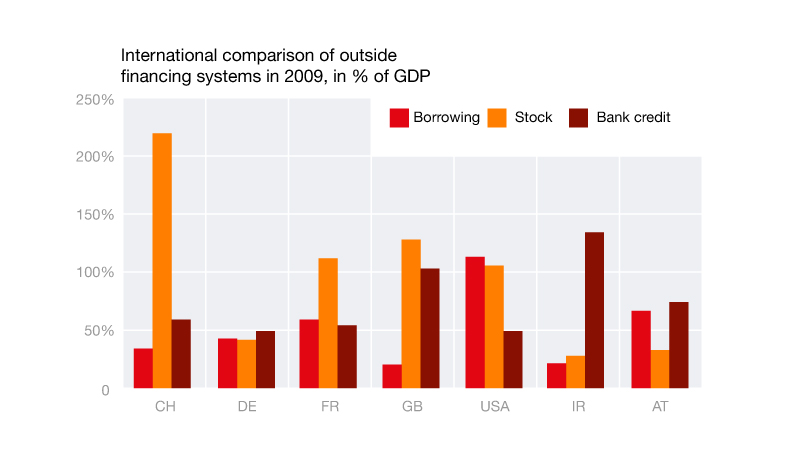

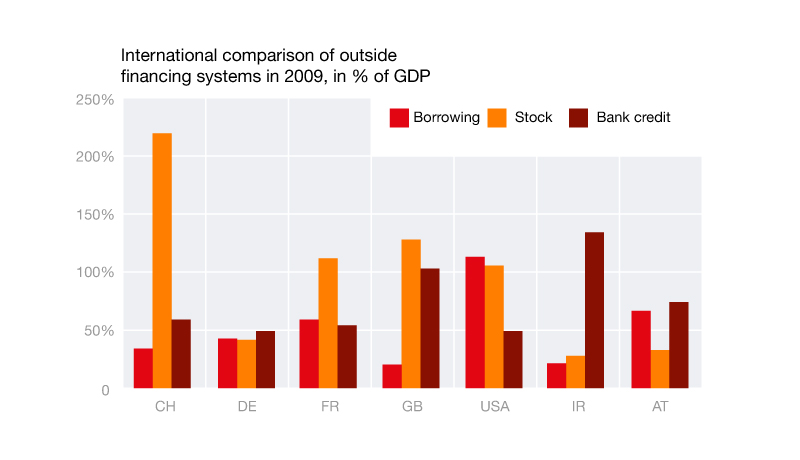

Financing of companies in general

Taking SMEs into account as well as large companies, Switzerland has an extremely high rate of stock market financing compared to the rest of the world. It represents more than 200% of the GDP, which is a proportion four to five times larger than bank credit and borrowing, according to the 2010 edition of the Credit Suisse Banks Manual.

Bank credits

Swiss SMEs that rely upon external funds essentially use bank credit. Below is a presentation of statistics.

Guarantees

Established to facilitate access to bank credit, SME guarantees are rapidly increasing and exceeding the objectives set by the Confederation.

SME financing: Venture capital

Investments tied to venture capital are well developed in Switzerland. Compared to the GDP, they have decreased slightly in recent years.