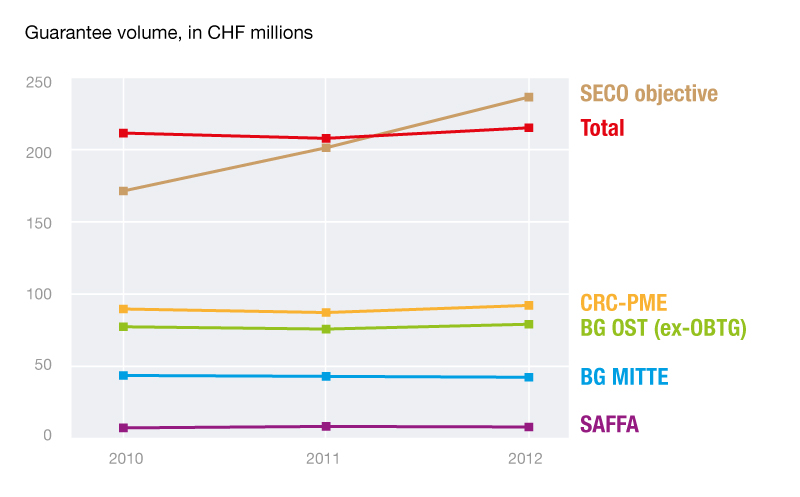

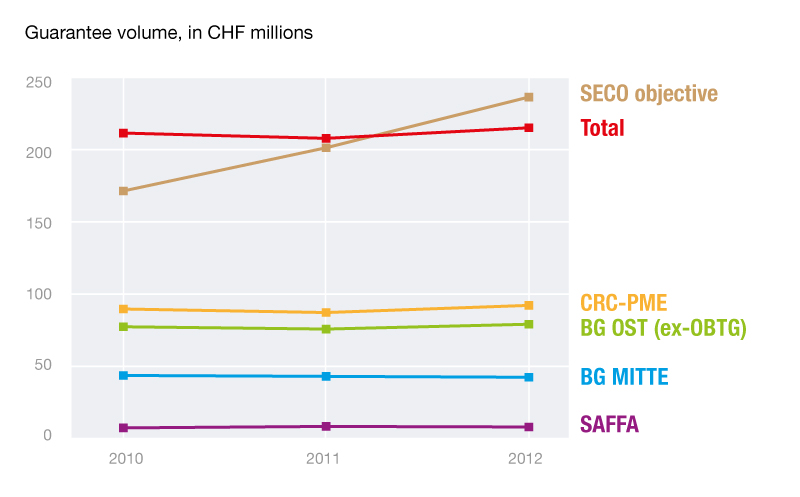

Established to facilitate access to bank loans, SME guarantees are rapidly increasing and exceeding the objectives of the Confederation.

The total volume of guarantees granted to SMEs is increasing very rapidly in Switzerland and is even largely exceeding the objectives set by the Confederation. This instrument to support companies helps them to obtain access to credit. It is offered by four guarantee cooperatives:

- Société coopérative de cautionnement SAFFA, for women

- CC Centre, guarantee cooperative for SMEs

- Coopérative romande de cautionnement - SME (CRC-SME)

- BG OST, Bürgschaftsgenossenschaft für KMU

See also: