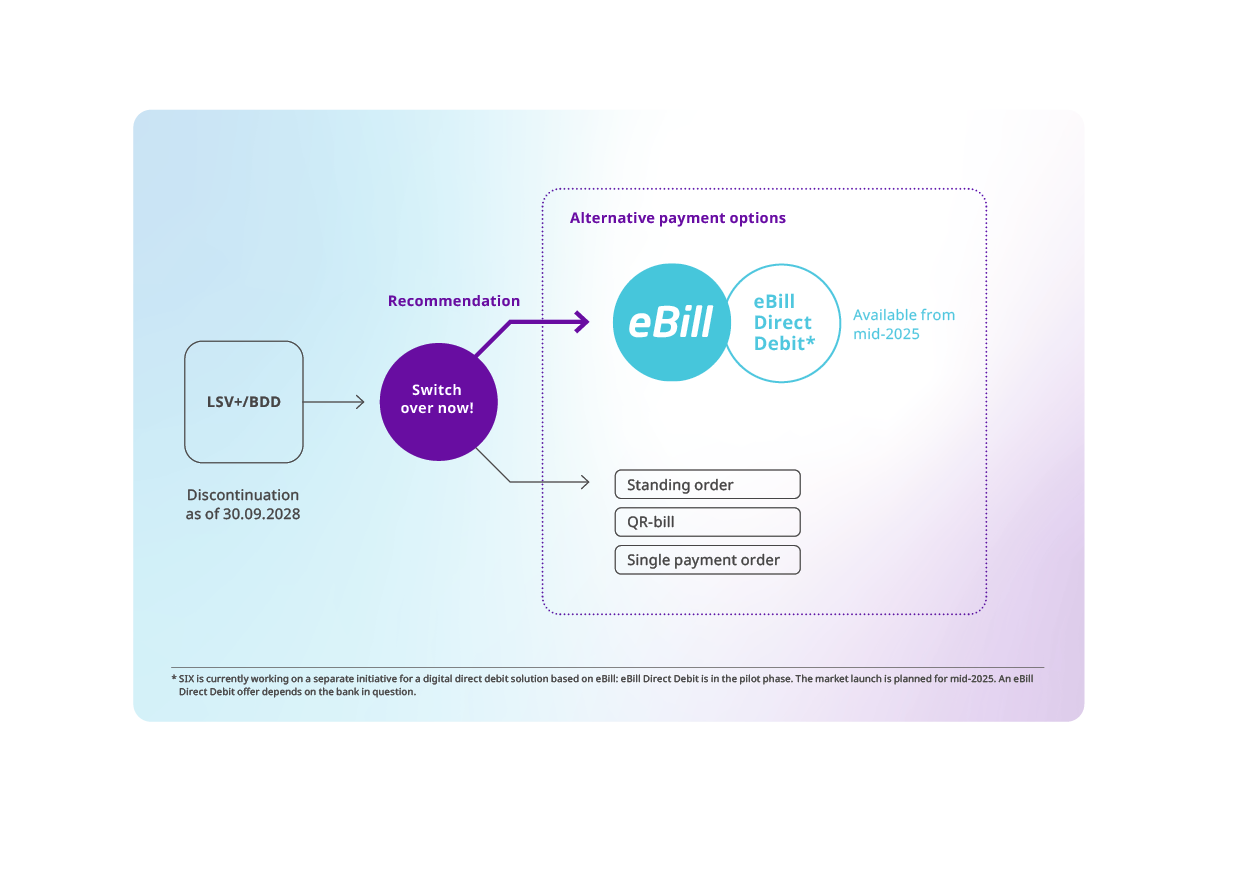

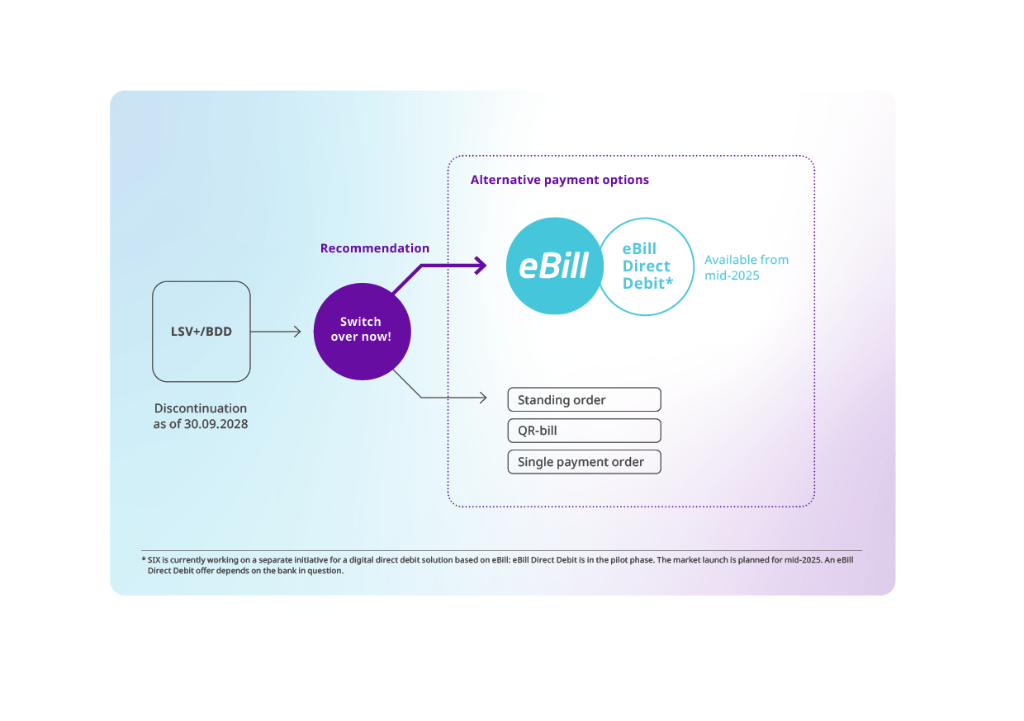

In consultation with the Swiss financial center bodies, SIX has decided to discontinue the existing direct debit procedures LSV+/BDD as of 30 September 2028. This will affect all market participants participating in LSV+/BDD in Switzerland.

Reasons for discontinuing LSV+/BDD

LSV+/BDD, introduced in 2005, are not fully compliant with ISO 20022. However, harmonization of payment standards is essential for efficient payment transactions. The necessary investments in technology and infrastructure would be costly for invoice issuers, software partners, financial institutions and SIX as the operator of the direct debit infrastructure. In addition, physical signatures are outdated, and declining transactions show that alternative payment methods are preferred.

Roadmap for discontinuation

Specifically, the discontinuation means that LSV+/BDD collections will only be available until 30 September 2028. This end date was deliberately chosen to give financial institutions, invoice issuers and software partners sufficient lead time to switch to alternative solutions.

Alternative payment options

Established formats such as eBill, QR-bill, standing order or single payment order are available for the period after LSV+/BDD are discontinued. The digital alternatives in particular offer both invoice issuers and their customers clear added value compared to LSV+/BDD, such as simpler activation and administration processes as well as greater transparency with regard to successful or rejected approval or payment execution, respectively. Analog customers who do not use eBill or online banking can, for example, obtain receivables by means of a QR-bill, depending on the individual offer of each financial institution.

In mid-2025, SIX will also launch eBill Direct Debit, a new digital direct debit procedure. This will be used to automatically collect recurring receivables. The necessary debit authorizations can be conveniently viewed and managed in eBill. eBill Direct Debit is designed for digital customers. SIX also offers a solution to extend eBill Direct Debit for use by analog invoice recipients. However, such an extension would have to be supported by the analog invoice recipient’s financial institution. Various financial institutions are currently evaluating future customer requirements in this regard. For more information on eBill Direct Debit, please click here.

What invoice issuers need to do

Invoice issuers are advised to decide early on which format they wish to use for future invoicing and to coordinate this with their financial institution and software partner. This will ensure a smooth transition to alternative payment formats.

The digitization of Swiss payments

The Swiss financial center has harmonized payment transactions to the ISO 20022 standard to ensure efficiency and competitiveness. The QR-bill replaced the payment slip, and eBill enables seamless digital payments. The discontinuation of outdated procedures such as LSV+/BDD is now the logical consequence.

Starting in 2025, SIX will introduce eBill Direct Debit, a digital direct debit procedure that makes processes more efficient and eliminates media breaks. This will strengthen the economy and benefit all market participants. However, analog payment options will remain in place.

For further information or questions, invoice issuers should contact their financial institution and their software partner.

Further information on the discontinuation of the LSV+/BDD direct debit procedures can be found here.

Author: SIX