An effective succession is not decided overnight, but rather, is the result of a lengthy thought-out process, which takes into account the maximum variety of options.

Sooner or later, all entrepreneurs need to think about succession. The moment considered by the entrepreneur as most suitable for starting this process depends on each individual, the company’s overall situation and whether a buyer already exists. Succession can even prove untimely if it occurs when the company is going through a difficult period, has just formed the subject of costly investments or is still in the process of launching a new product. Planning succession makes it possible to prepare for the unfortunate event of the early disappearance of the company owner, due to accident or illness for example. This scenario can jeopardize the whole deal if no anticipatory measure has been provided for by the entrepreneur.

Think about your company succession sufficiently in advance

In Switzerland, about one out of three companies closes down for lack of buyers, according to the "KMU Nachfolge - Quo Vadis?" study of the KMU Next foundation published in 2024. Since a successful company transfer usually takes several years, an entrepreneur has everything to gain by reflecting on their succession as early as possible, in order to correctly plan the stages and avoid any unpleasant surprises.

It is wise to think about succession once you enter your 50s. It is considered early if it occurs at the age of 60, normal between the ages of 62 and 65, and late after the age of 68.

In all cases, prudence and considerable thought are required on the part of the entrepreneur facing the challenge of their own succession. They are recommended to carefully consider all succession options and prepare to change strategy during the process if necessary (for example, if a natural heir withdraws during the transfer process).

Several stages

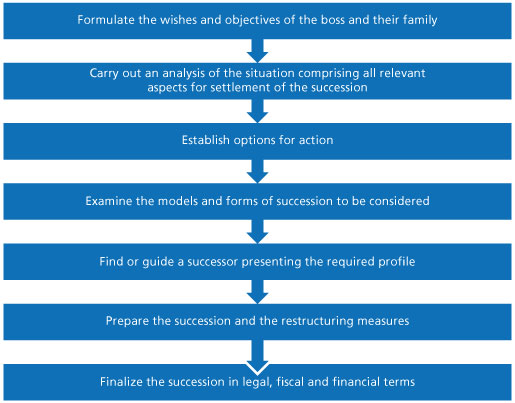

Once the decision to introduce the succession process has been taken, the wishes and objectives of the entrepreneur and their family need to be defined. Next, it is recommended to perform an analysis of the actual situation of the company under the guidance of an external advisor. The wishes and objectives are compared with this analysis to define possible approaches to guide the structure and culture of the company early enough regarding the succession. For this, it is necessary to determine whether the takeover can be handled internally, within the family, or whether an external solution should be considered.

If there is no successor within the family, an ideal person needs to be found. Preparation and restructuring measures can be implemented in order to facilitate the sale to a third party, such as company demerger, distribution of bonuses with a view to relieving pressure on the company and guaranteeing old-age pensions, or transformation of the legal structure or management. To conclude, the succession is finalised in legal, fiscal and financial terms.