Some financial companies have become specialists in granting venture capital. Here is an overview.

Some financial companies have become specialists in granting venture capital. These venture capital firms contribute to the share capital and expect significant profits when the business they are supporting is flourishing or even quoted on the stock market. They make their resources available without the traditional safety measures.

Venture capital firms prefer successful young companies posting strong growth in a short space of time and which, generally, require capital of several million Swiss francs. The provision of venture capital is often accompanied by support and advice from management.

Venture capital firms chaperone the new business during the start-up phase of the financing project. Once their work is done, they usually withdraw and sell their interests to other investors.

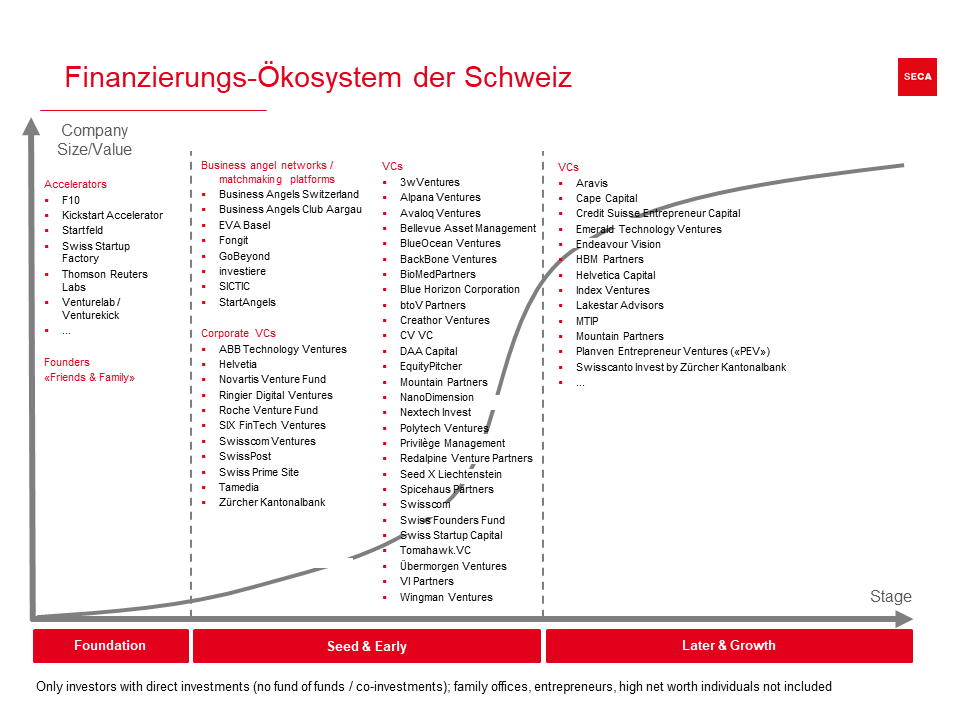

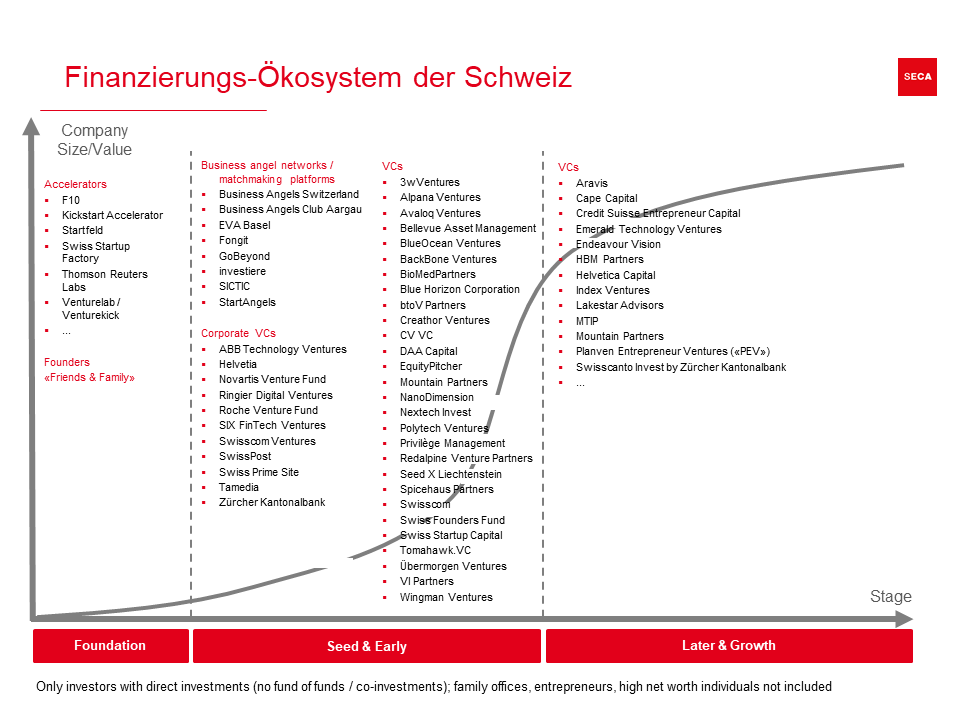

In Switzerland, venture capital firms are part of the Swiss Private Equity & Corporate Finance Association, SECA. In Europe, venture capital firms are part of Invest Europe (formerly known as EVCA).